Using a credit card to finance purchases can be convenient and rewarding when used responsibly. Credit cards offer benefits like cashback, rewards points, and fraud protection. However, it’s crucial to recognize that there are instances when using a credit card is not a positive financial choice. Misusing credit cards or relying on them too heavily can lead to significant financial stress and debt. In this article, we will explore the scenarios where using a credit card to finance purchases may not be a wise decision and why it’s important to avoid such practices.

Accumulating High-Interest Debt

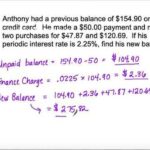

One of the most significant disadvantages of using a credit card to finance purchases is the accumulation of high-interest debt. Credit cards often come with high Annual Percentage Rates (APR), especially if the balance isn’t paid off in full each month. When you carry a balance from month to month, interest charges can quickly add up, making the cost of your purchase significantly higher than the original price. This is particularly harmful if you are making large purchases or consistently using your card without a plan to repay the balance promptly.

Living Beyond Your Means

Credit cards provide the ability to make purchases even when you don’t have cash available, which can tempt individuals to live beyond their means. Financing purchases with a credit card allows you to spend more than what you can afford at the moment, leading to financial instability. Overspending due to easy access to credit can result in a cycle of debt that becomes difficult to break. Instead of using a credit card to finance purchases that exceed your budget, it is crucial to focus on living within your means and avoiding unnecessary debt.

Minimum Payments and Long-Term Debt

Making only the minimum payments on your credit card balance is another negative reason for using credit to finance purchases. Minimum payments are designed to stretch out the repayment period and maximize the interest paid over time. If you consistently pay only the minimum, it can take years to pay off even a modest balance, and the total amount you end up paying will be much higher than the original purchase price due to interest accumulation. This practice can trap consumers in long-term debt, which harms their financial health and limits future financial opportunities.

Impulse Buying

Credit cards make it easy to make impulse purchases because the payment is delayed. Financing purchases with a credit card might encourage impulse buying, where you make decisions based on immediate desires rather than thoughtful planning. Impulse buying can lead to financial problems as the accumulated charges may exceed what you can comfortably repay at the end of the month. Without careful budgeting, these spontaneous purchases can derail your financial goals, leading to a higher debt load and added stress.

Lack of Financial Discipline

Using a credit card to finance purchases can foster a lack of financial discipline. If you rely on credit cards for everyday expenses without having a plan to pay off the balance, it can create bad spending habits. The convenience of using a credit card might make you less mindful of your spending, which leads to poor financial management over time. Additionally, without proper discipline, you might find yourself trapped in a cycle of debt, as credit card bills continue to grow.

Ignoring the Total Cost of Purchases

Another negative reason for using credit cards to finance purchases is that it’s easy to ignore the total cost of what you’re buying. With the ability to swipe and go, many people don’t consider how much their purchase will actually cost once interest is factored in. This is especially true for big-ticket items. If you don’t have a plan to pay off the credit card balance quickly, the added interest over time can make the final price of the item much higher than expected. Financing purchases with a credit card without considering the full cost is a common mistake that leads to financial strain.

Hurting Your Credit Score

One of the most important reasons to avoid using a credit card to finance purchases is the potential harm to your credit score. Your credit utilization ratio—the amount of available credit you’re using—affects your credit score. If you consistently finance purchases and carry a high balance on your card, your credit utilization will increase, which can negatively impact your credit score. A lower credit score can make it more difficult to obtain loans, qualify for favorable interest rates, or even secure housing or employment.

Relying on Credit as an Emergency Fund

Using a credit card as an emergency fund is not a positive reason to finance purchases. While credit cards can provide a safety net in unexpected situations, relying on them as your primary source of emergency funds is risky. In the event of a financial emergency, you may find yourself quickly accumulating debt, which could take years to repay. Building a cash emergency fund is a more secure and financially responsible strategy than depending on credit cards.

Hidden Fees and Charges

Credit cards often come with hidden fees and charges that make financing purchases more expensive than they initially appear. These fees can include late payment fees, annual fees, foreign transaction fees, and over-limit fees. If you are unaware of or overlook these charges, they can add up quickly, increasing your debt burden and making it more difficult to repay your credit card balance. It’s essential to understand all the terms and fees associated with your credit card before using it to finance purchases.

Encouraging Dependency on Credit

Financing purchases with a credit card can create a dependency on credit that is hard to break. If you consistently use credit cards to cover daily expenses or larger purchases, you may start to rely on them as a crutch for financial management. This can lead to a situation where you are constantly in debt, with little room to save or invest. Instead of using credit as a fallback, it’s important to build good financial habits, such as saving for larger purchases and budgeting effectively, to avoid becoming overly reliant on credit.

Conclusion

While credit cards offer many conveniences and benefits, it’s important to recognize the potential pitfalls of using them to finance purchases. Accumulating high-interest debt, fostering poor financial habits, and relying on credit to cover emergencies or daily expenses can have long-lasting negative effects on your financial health. By avoiding these common traps, you can use credit cards wisely and maintain control of your finances. Always remember that credit cards should be tools for convenience and rewards, not crutches for financial instability. Maintaining discipline, paying off your balance in full each month, and budgeting responsibly will help you avoid the negative consequences associated with financing purchases on credit.