A finance charge is a fee that lenders apply to the total amount borrowed, acting as a cost for the credit or loan provided. This charge is typically added to credit card balances, loans, and other forms of borrowing, allowing lenders to generate profit from lending money. The finance charge can vary based on several factors, including the type of loan, interest rates, and terms of the borrowing agreement.

Finance charges are common in various financial transactions, from credit cards and mortgages to personal loans and auto loans. For anyone utilizing credit, understanding how these charges work is essential to managing finances efficiently. Let’s dive deeper into what finance charges are, how they are calculated, and why they are important.

Definition of a Finance Charge

A finance charge is essentially the cost of borrowing money. It represents any fee or interest charged by lenders for providing credit to the borrower. The most typical form of a finance charge is interest, but it can also include other fees such as transaction fees, service fees, and late payment penalties. It’s the way financial institutions make money on loans or credit provided.

Understanding the breakdown of finance charges can help borrowers better plan their repayments and manage overall loan costs. By doing so, consumers can avoid extra costs and make smarter financial decisions.

Types of Finance Charges

Finance charges cme in different forms, depending on the type of borrowing arrangement. Here are the most common types

Interest Charges

This is the most common form of finance charge. The lender charges a percentage of the outstanding balance, which is known as the interest rate. This charge accrues over time and can increase depending on the loan term and the outstanding balance.

Late Payment Fees

If a borrower misses a payment deadline, they are often charged a late fee. These fees are typically added on top of the outstanding balance, increasing the overall cost of the loan.

Annual Fees

Some credit cards and loans come with an annual fee, which is considered a finance charge. This fee is charged yearly for simply having access to the credit line or loan, regardless of usage.

Service Fees

Some lenders charge service fees for processing or maintaining a loan or credit account. These fees are typically fixed and applied either monthly or annually.

Transaction Fees

Certain transactions, such as balance transfers or cash advances, may come with additional transaction fees. These are charged separately from interest and are a one-time fee applied when the transaction occurs.

Each of these finance charges contributes to the overall cost of borrowing, making it essential for consumers to read through their loan or credit card agreements carefully.

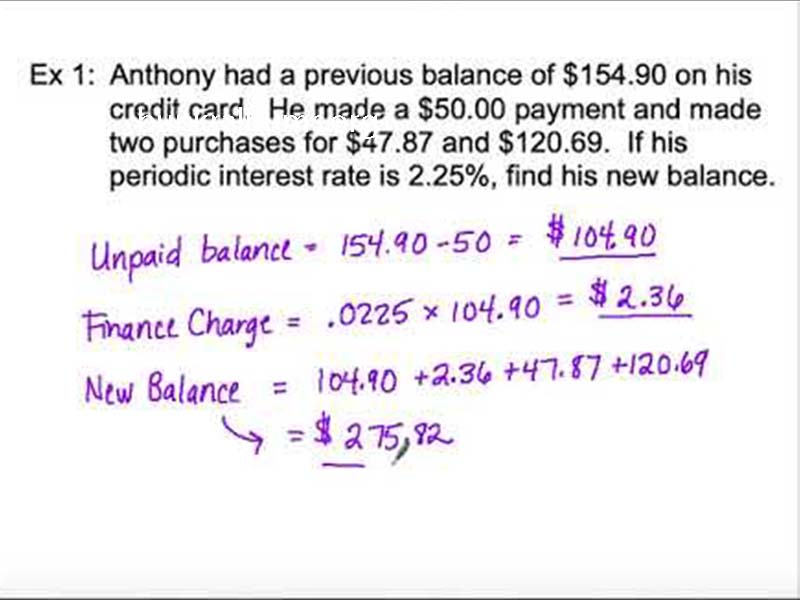

How Are Finance Charges Calculated?

The calculation of finance charges can differ depending on the type of loan and lender, but the most common method is based on the annual percentage rate (APR). The APR is the yearly interest rate that borrowers will pay on the loan. To calculate the finance charge on a loan or credit card, lenders typically use the following methods:

Simple Interest Calculation

This is the easiest method to calculate a finance charge. Lenders multiply the loan balance by the interest rate and then divide by the number of days in the year (365). This method is commonly used for short-term loans or those with fixed rates.

Average Daily Balance

For credit cards, the finance charge is often based on the average daily balance. Lenders calculate the average balance for the billing period and then apply the interest rate to determine the finance charge.

Balance-Based Method

Some loans use a balance-based method where the finance charge is calculated based on the remaining loan balance. As the borrower pays down the loan, the amount of interest charged decreases.

Understanding these calculations allows borrowers to estimate their future finance charges, giving them the power to manage their finances better.

Why Finance Charges Matter

Finance charges are essential for lenders because they allow them to earn profit on the credit they extend to borrowers. However, for borrowers, these charges can significantly impact the total cost of borrowing. Here’s why finance charges matter

Cost of Borrowing

Finance charges directly increase the total amount you’ll pay over the life of a loan or credit card balance. Even a small difference in interest rates can lead to large savings or expenses over time.

Budget Planning

Knowing how much your finance charges will be helps in budgeting for your monthly expenses. By understanding these costs, borrowers can better prepare and avoid financial strain.

Debt Management

Finance charges can make it harder to get out of debt. If not managed carefully, they can accumulate quickly, especially if only minimum payments are made on loans or credit cards.

Managing and understanding finance charges are critical for maintaining financial health, particularly for consumers who rely on loans or credit for big purchases.

How to Minimize Finance Charges

There are several strategies borrowers can use to reduce finance charges and save money over the long term

Pay Off Balances Early

One of the most effective ways to minimize finance charges is to pay off the loan or credit card balance as early as possible. By doing so, you reduce the amount of interest that accrues over time.

Make More Than the Minimum Payment

Making only the minimum payment on a loan or credit card can result in more finance charges over time. To reduce costs, try to pay more than the minimum each month, as this will lower the outstanding balance and reduce interest accrual.

Choose a Loan with a Lower APR

When shopping for loans or credit cards, look for options with a lower APR. Even a small reduction in interest rates can make a big difference in the total finance charges you’ll pay.

Avoid Late Payments

Late payment fees can add up quickly and increase the overall cost of borrowing. Set up automatic payments or reminders to ensure that you always pay on time.

Limit Balance Transfers and Cash Advances

Balance transfers and cash advances often come with high transaction fees and interest rates. Avoid using these features unless absolutely necessary.

Consolidate Debt

If you have multiple loans or credit cards with high finance charges, consider consolidating them into one loan with a lower interest rate. This can simplify your payments and reduce the overall cost of borrowing.

By taking these steps, borrowers can reduce the amount they pay in finance charges, freeing up more money for savings or other financial goals.

Conclusion

A finance charge is an essential component of borrowing money, representing the cost that lenders charge for providing credit or loans. Understanding how finance charges are calculated and applied to your balance is critical for managing debt and making smart financial decisions. Whether you’re using a credit card, taking out a personal loan, or financing a big purchase, being aware of the various finance charges involved can help you minimize costs and better control your financial situation.

By paying off balances early, avoiding late fees, and shopping for loans with low interest rates, borrowers can significantly reduce the impact of finance charges. With careful planning and a good understanding of how these charges work, consumers can make informed decisions about their finances and avoid unnecessary costs.

In summary, finance charges are an unavoidable part of borrowing money, but with the right strategies, they can be managed effectively. Understanding these charges and how they impact your overall debt will put you in a better position to achieve your financial goals.